Maintaining The Balance Sheet

Finding oneness and balance is the only source of genuine happiness.

– Anonymous

In this unit we will be discussing the accounting equation, double-entry accounting, types of assets, types of liabilities and equity. The balance sheet will help provide balance to your business. It helps keep everything organized and on point. One of the worst things in accounting is un-organization. So, don’t treat your balance sheet like your sock drawer at home or that mysterious junk drawer in your kitchen that no one wants to organize.

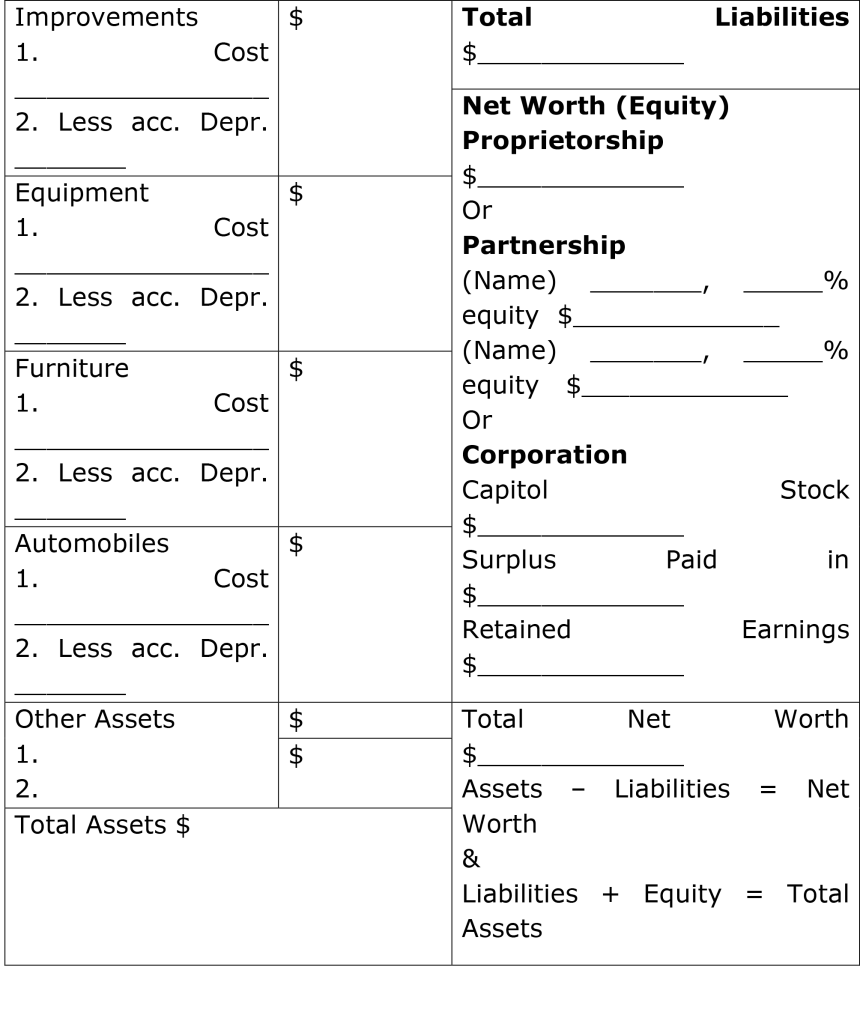

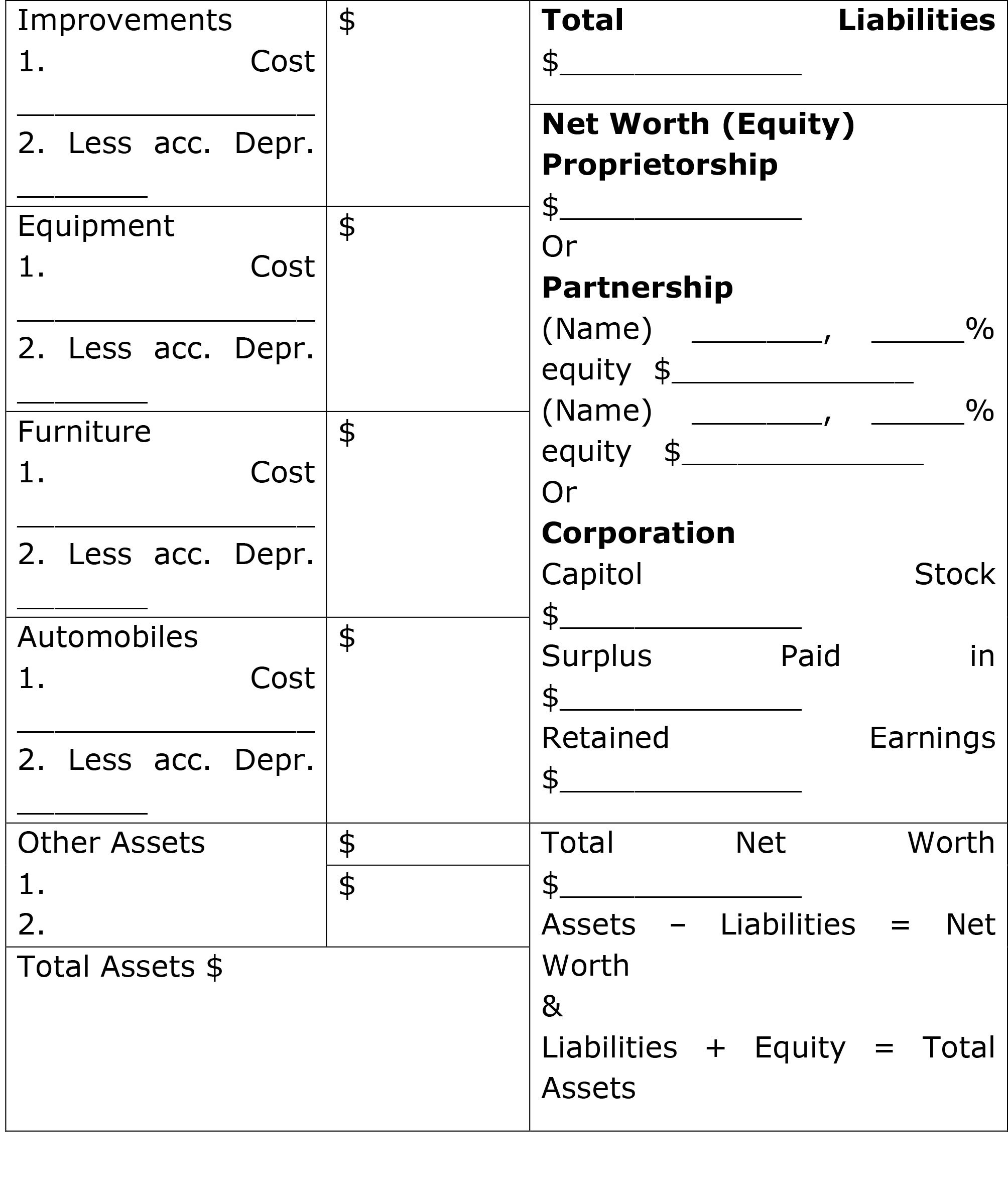

A balance sheet is a financial statement that shows the assets, liabilities, and owner’s equity at a specific point in time. Assets and liabilities are usually listed first, followed by the equity which is the difference between the assets and the liabilities. The balance sheet will ultimately provide a snapshot of the company’s current financial condition.

Example: Bob & Tom’s Crunchy Cookie Co. had an impressive increase in sales this past month however, the company is only three months old and they therefore still have a number of liabilities to attend to. In order to keep track of their increases and to determine the financial position of their business this month, Bob and Tom will need to summarize their business assets, liabilities, and equity into what is known as a balance sheet.

Balance Sheet

The Accounting Equation

The accounting equation is simple. It is the combination of liabilities and equity, which equals assets.

Assets = Liabilities + Equity

The accounting equation helps to identify the relationship between crucial elements of accounting. An asset is anything of value, that which a company owns. Assets consist of tangible and intangible assets. Examples of current assets include: stocks, bonds, cash, and property. Liabilities are, a company’s existing debts that are owed to third parties .Examples of liabilities would be, accounts payable, wages payable and interest payable.

Double-Entry Accounting

Double entry accounting involves credits and debits. This will show information about increases and decreases in one balance statement. This can also be known as a “T” account because it looks like the letter “T” on paper, consisting of the debits on one side and the credits on the other. This method provides a simple way to accurately and efficiently balance the sums in accounts using the debit and credit method. Remember, debits should be equivalent to credits. You should not do a debit without a credit if you want to keep everything balanced.

Types of Assets

Liabilities + Equity = Total Assets

Assets are probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. Anything that has an economic value and can be owned or controlled to produce value has the potential to produce such future economic benefits. Whether tangible or intangible, ownership of any form of value is considered to be an asset.

Basically anything worth anything can be an asset. Now let’s not get carried away here, we’re not talking about the pack of gum at the bottom of your purse, or the teddy bear that’s missing an eye you had when you were a child. We’re also not talking about that blue velvet armchair sitting in your man cave that you inherited from your uncle’s, cousins’, Brother-in-law. Then again, you know what they say about another man’s trash. Anyway let’s get back to business. There exist both tangible and intangible assets. Cash is a tangible asset whereas ownership in stock is an intangible asset.

Tangible assets are belongings that can be physically touched and/or seen, they are real and actual rather than hypothetical. As mentioned before, cash is a tangible asset. Others include real estate, equipment, automobiles, and other physical valuables. Intangible assets are non-physical assets which have a useful life, lasting usually more than one year. They can include patents, trademarks, internet domain names, literary and musical works, and patented technology.

Example: Bob and Tom have ordered a few industrial sized ovens for their growing cookie business. These ovens along with refrigerators, dining furniture, and other supplies and equipment essential for their business, are all tangible assets. Bob and Tom have also created an original slogan for their cookie company which is growing to be quite popular; this slogan can be viewed as one of their intangible assets.

Types of Liabilities

Probable future sacrifices of income or assets, arising from present obligation to a particular entity. If liabilities are settled, they may become transferred assets or provide services to other entities in the future as a result of past transactions or events. It is a duty or responsibility to another in return for some form of debt such as a business loan which would entail the settlement of that loan. These can be current or long-term.

I know that’s a mouth full, so let’s clarify. An example of a liability would be, before Bob and Tom purchased their top of the line ovens, they attempted to borrow the money from a family member who would in-turn receive a small percentage of the company’s revenue. Since the cookie company was a new business, the family member decided not to go through with the deal because their potential loss would be greater than the potential gain, if the company folded. Whereas the bank agreed to loan them the money based on their projected business potential and business plan, because the bank could afford to do so.

Equity

The interest in the assets of an entity that is left over after all liabilities are deducted or ownership in assets after all debts owed for that asset have been paid off. Assets such as stock and home ownership can be considered equity if no associated debts remain. Once a house or automobile is paid off, the asset is now the owner’s equity. Equity is any asset that can be sold for monetary gain without any attached debts being owed. The owner should gain 100% of the revenue from the sale of an asset if that asset is their own equity. However, if there are more liabilities than assets, then negative equity exists.

In the stock world, equity involves an investment in shares or stock on a stock market. Just as individuals can buy stock, so can businesses. As the value of stock rises, so will their equity. Many individuals do not hold their shares directly; instead they are involved in what is called a mutual fund. These funds are usually managed by larger companies and management firms. Having the support and management of a company will allow individuals to leave the management of their shares in the hands of a skilled, professional fund manager. Larger, private businesses and investors however will often hold their own stock rather than seeking a third party Management Company. Equity in stock is generally termed shareholders equity.