Understanding Accounting Jargon & Technical Language (Part 1)

The company accountant is shy and retiring. He’s shy a couple of million bucks, that’s why he’s retiring!

– Milton Berle

This lesson assumes students have no prior knowledge about accounting or finance, and delivers lessons and examples to build accounting skills. Specifically, this lesson addresses accounting terminology, revenue, expenses, net income, the accounting equation, debits, credits, and balancing the accounting formula, the accounting structure, the accounting cycle, journals, ledgers, the trial balance and more. It also guides students to learn how to read financial statements properly, and how to grab meaningful information from the balance sheet, income statements and cash flow statements. One fact about accounting is that you have to start at the beginning, or you will get lost. So let’s start there, with some basic terminology. Some of this stuff may ring a bell for those of you who took accounting previously, were hired to keep the books at the corner Mom & Pop’s shop, or, were too cheap to hire a “real Accountant” and tried to do your own books. (How did that work out for you?). Either way, when we are done here, you are bound to be familiar with a lot of these basic bookkeeping and accounting terms.

Warm Up Exercise

- List three areas in relation to bookkeeping you feel you are strong.

- List three areas in regards to bookkeeping where you would like to see improvement.

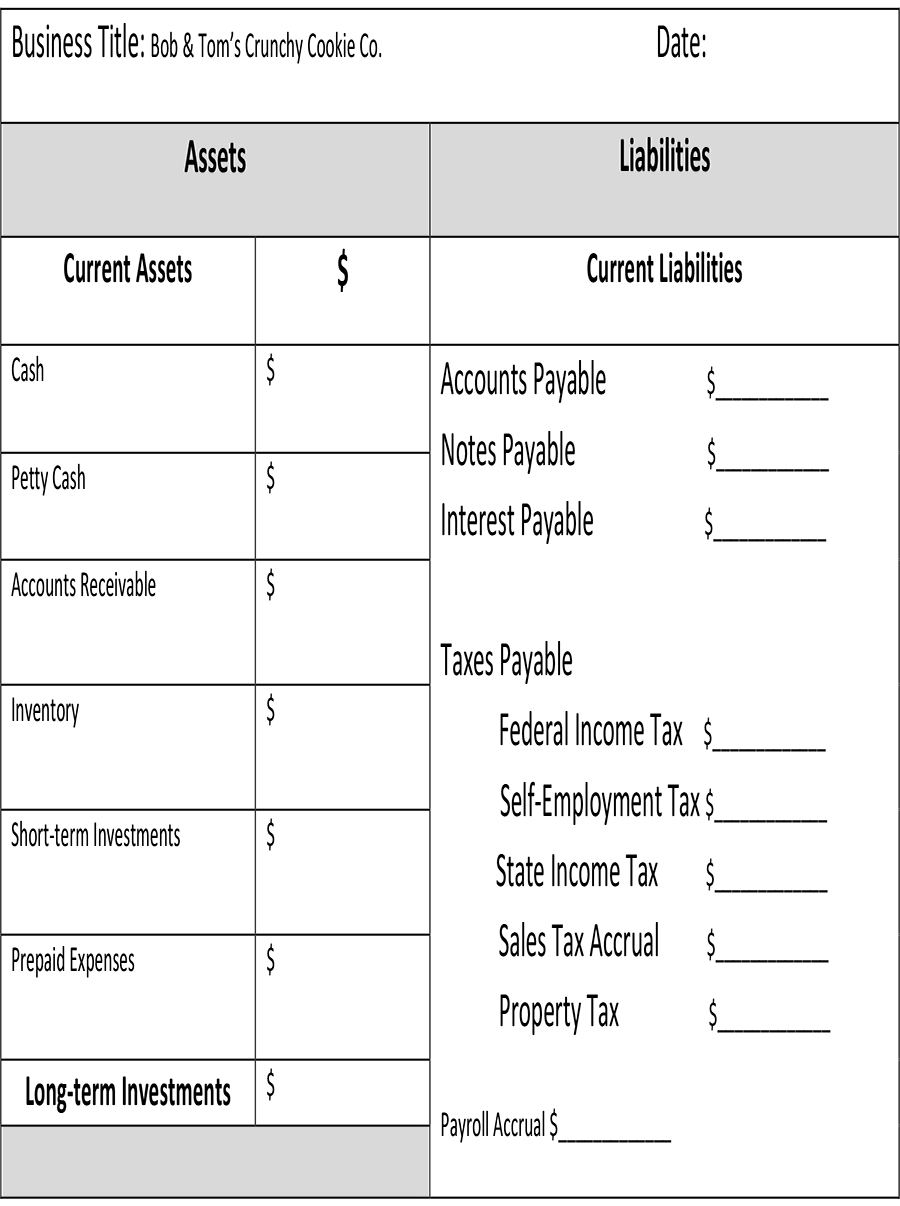

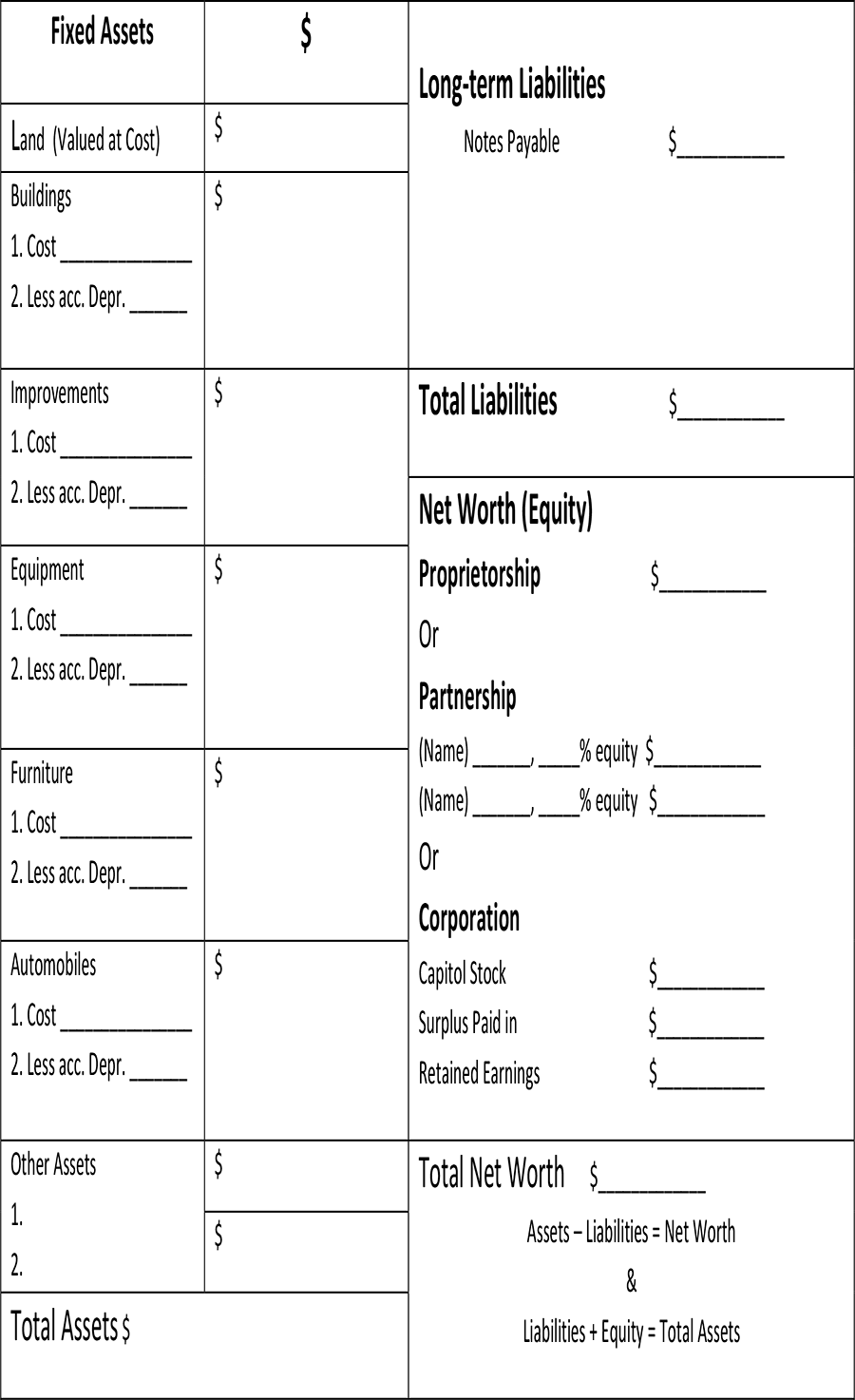

Balance Sheet

A balance sheet is a financial statement that shows the assets, liabilities, and owner’s equity at a specific point in time. Assets and liabilities are usually listed first, followed by the equity which is the difference between the assets and the liabilities. The balance sheet will ultimately provide a snapshot of the company’s current financial condition.

Balance Sheet

Assets

Assets are probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. Anything that has an economic value and can be owned or controlled to produce value has the potential to produce such future economic benefits. Whether tangible or intangible, ownership of any form of value such as cash money or stock is considered to be an asset.

Liabilities

Probable future sacrifices of income or assets, arising from present obligation to a particular entity. If liabilities are settled, they may become transferred assets or provide services to other entities in the future as a result of past transactions or events. A liability is a duty or responsibility to another in return for some form of debt such as a business loan which would entail the settlement of that loan.

Equity

Ownership in assets after all debts owed for that asset has been paid off. Assets such as stock and home ownership can be considered equity if no associated debts remain. Once a house or automobile is paid off, the asset is now the owner’s equity. Equity is any asset that can be sold for monetary gain without any attached debts being owed. The owner should gain 100% of the revenue from the sale of an asset if that asset is his or her own equity.

Income Statement

A financial statement is used to summarize the amounts of revenues earned, and the expenses incurred by a business or entity over a period of time. It is used to measure a business’s financial performance. This statement includes a summary of how a business typically incurs its revenues and expenses over a fiscal quarter or year.

Revenue

The fee paid to a lender for a loan or all transactions for which monies are received. It can be the income from products and services sold and the use of investments. Revenue can also be a transaction and the resulting income for which monies are received, however, loan funds and equity deposits are not considered revenue.

Cost of Goods Sold

The cost of producing products that are delivered to customers to create revenue or the cost of inventory sold during an accounting period. This includes the cost of purchases made during an inventory period minus the ending inventory for that period. This term is often abbreviated as COGS.

Expenses

Expenses are the cost of producing revenue through the sale of goods or services. They can come in many forms such as salaries or wages, and depreciation of assets. An expense can be almost anything that is incurred when doing business.

Accounting Period

The Accounting period is the amount of time in which income statements and other financial statements are utilized to track and report operating results. They usually run for twelve months between January to December, but can begin and end anytime depending on the businesses needs or wants.

Lesson One: Review

You should now be familiar with a few general accounting terms most often used for businesses. Remember:

A balance sheet is a financial statement that shows the assets, liabilities, and owner’s equity at a specific point in time.

Whether tangible or intangible, ownership of any form of value such as cash or stock is considered an asset.

Liabilities are probable future sacrifices of income or assets, arising from present obligation to a particular entity.

Equity can be ownership in assets after all debts owed for that asset have been paid off.

An income statement includes a summary of how a business typically incurs its revenues and expenses over a fiscal quarter or year.

Revenue can be a transaction and the resulting income for which monies are received.

Cost of Goods Sold is the cost of purchases made during an inventory period minus the ending inventory for that period.

Expenses are the cost of producing revenue through the sale of goods or services.

An accounting period is a period of time in which income statements and other financial statements are utilized to track and report operating results.