Cash Flow Monitoring

Never ask of money spent, where the spender thinks it went, nobody was ever meant, to remember or invent, what he did with every cent.

– Robert Frost

Knowing how to keep track of your business will prove to be very valuable in the short run and long run. There are a number of different aspects involved in keeping track of any business the right way. Many businesses go out of business within the first year or two if things are not handled properly. Have you ever been up late at night, just craving one of those good old roast beef sandwiches from the local 24 hour deli? You find that the craving gets so bad, you get up, leave (in your plaid jammies) and take a ride over there, with your mouth watering the whole way. You pull up, and hop out of the car (very excited), only to find that your favorite business is no longer “in business.” One could assume they did not keep very good track of their business or, they moved.

Knowing how to keep track will hopefully help keep you in business, not to mention having customers, capital, and all those other things that keep a business afloat. In this section, we will discuss the ins and outs of accounts payable, accounts receivable, the journal, the general ledger, and cash management.

Accounts Payable

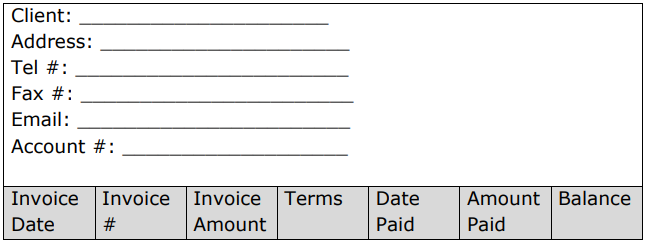

This type of record is used to keep track of money which is owed to a business. Such money can come from extending credit to a customer who purchases the business’ products or services. The best way to keep track of these records is to set up a separate “accounts receivable” record for each customer.

If a business makes a sale or renders a service, it has “receivables.” This means that the business has money to collect or receive for its products or services. Such collectable money is usually in the form of an operating line of credit. Accounts receivable can be recorded as an asset on a business’s balance sheet because it represents a future payment. The customer who has received the products or services from the business is legally obligated to pay for them per the agreement set between the two parties, thus the business can list this customers debt to them as an asset. An example of a receivable in the everyday world is a paycheck. Employers are legally bound to pay their employees for the services they have already rendered.

Accounts Receivable

Account Record

The Journal

The journal is a way to keep track of all inputted information or data with regard to a business to allow for the books to be properly balanced.

The Balancing Act: When dealing with journals, you will also be dealing with debits and credits. You cannot use one without the other, for every debit there must be a credit in order to keep things balanced. You can use one journal for all transactions or several journals for similar or like transactions. A simple example is when we keep track of our checkbooks by entering both our purchases, which would be considered debits and our deposits, which would be considered our credits or money received. This is known as balancing a checkbook. Keeping a journal is basically the same concept. Remember, always try to be as accurate as possible or you will throw everything off balance.

The General Ledger

In double-entry accounting, these are forms used for the accounts on separate sheets, in a book or binder and are called the general ledger. This is considered a permanent, classified record for each business account.

The general ledger is usually the main record of accounting that a business uses. It can include assets and liabilities as well as gains and losses, along with the revenue and expense items that caused the gains and losses. This record will often take the form of a “T-Account”, showing all debits on the left side of a T-shaped chart and all credits on the right. The ledger is an accumulation of all of a business’ finances, from their journals and other records. It can then be used as a basis for both the balance sheet and income statement because it provides all of the needed transactions. The size of a general ledger can vary immensely depending on the size of the business.

Cash Management

Cash management is the process of collecting, managing, and investing cash. Cash management can ensure a business’ financial stability by avoiding insolvency. In a business, the term “cash” does not only refer to money or the amount of money at the end of the year. Cash and the management of cash can also be used to refer to managing anything that can be made liquid like, certificate of deposits by selling them, short term investments, and anything that can be used as a cash equivalent. The art of cash management in a business is very important because it is essential in keeping a business operating properly. If there is a mismanagement of cash, it may result in a big loss of revenue for any business. Proper cash management will help make sure a business does not become insolvent. Anytime a business cannot pay any of its bills due to a lack of cash that means it has become insolvent. Insolvency is the main reason a company may go bankrupt.